New Release May 2020

Loanboox works perfectly in all areas even during the Corona crisis. Our software development team has rolled out the new release from home office. Here are the most important changes.

Website:

New design

There’s not much to explain – we hope you find it intuitive and you like it.

Focus on relevant content: Our new blog

We will provide you with whitepapers, market information, factsheets and much more in our new blog. Come back regularly to check the news.

Lenny and Noa, our chatbots

The Loanboox family has grown: Lenny and Noa, our two virtual colleagues / chatbots. They are happy to answer your questions or forward them to the human colleagues. The chatbot tool is from the Swiss start-up Aiaibot. Try it out (just click on the head in the bottom right corner), there is a lot to discover 🙂

Platform:

New design

The platform also got a fresher look, a more intuitive user interface, simplified tab structures, action buttons and a revamped document center.

Support

In order to be able to support you in the best possible way, we have introduced two new features: On one hand, you will find your direct contact person displayed on the start page. If you have any questions, you can always contact him or her via chat or call. On the other hand, there is a step-by-step assistant for the most important functions which should help you to get used to the new interface very quickly.

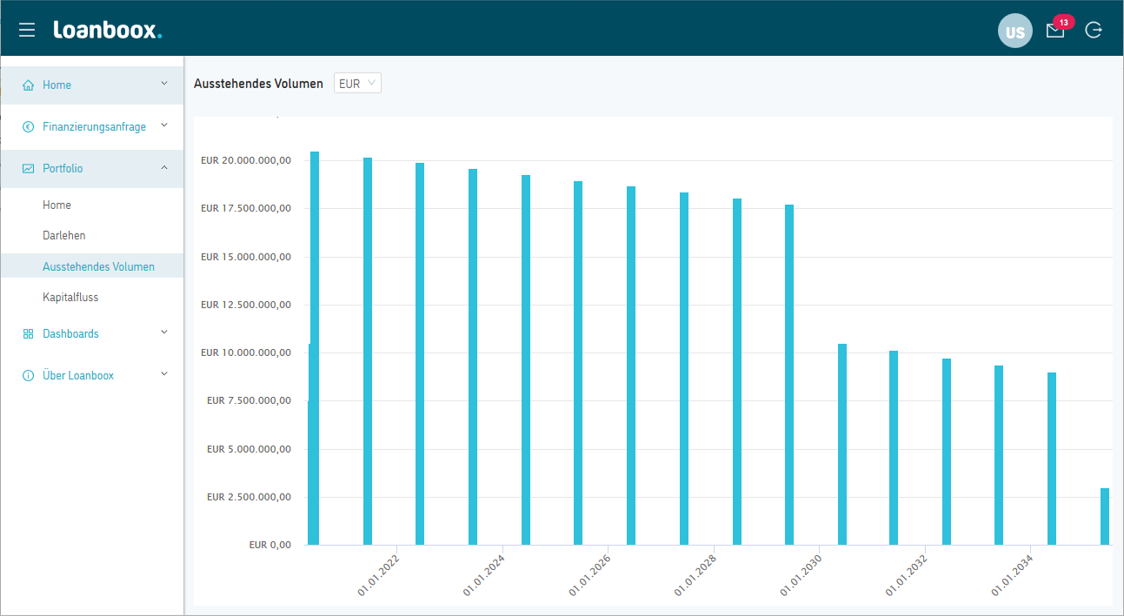

Specially interesting for borrowers: The portfolio

As of now, we offer our borrowers a portfolio. On one hand, you can see the most important facts about your previous financing requests at a glance (interest payment dates, expiration dates and volumes etc.), you can renew and find expiring loan tranches with just a few clicks. You can also add the loans closed outside of Loanboox, so that you have an overview about all your loans in your portfolio. On the other hand, you can find current market developments and interest rate overviews graphically displayed.

Specially interesting for investors: Investor profile and direct loans

Now you have the possibility to adjust your filter criteria in your investor profile according to maturity, currencies, segments, regions, etc. – so that they correspond exactly to what you are interested in and you will only be informed in case of matching requests. Loanboox has also launched a new product, direct loans. As an investor, you can reach a large number of borrowers in only one step and the borrowers can complete their offers in just two clicks; no tender, no effort, efficient for both contracting parties. For further information please don’t hesitate to contact us.

Recommendation for all our users: Do not use IE 11 anymore

Refresher needed or get started right away?

Apart from these adjustments, there are many other new features you can discover on the platform.

Would you like to learn more about the new release? We are happy to explain the functionalities in detail in a webinar or you can test it yourself directly on the new platform.

– for registered users –

– for new customers and registered users –

Questions or remarks?

If you have any questions, please feel free to contact us via chat or by phone (+49 221 9865420). We look forward to working with you in the future to make the debt capital markets more accessible, efficient and transparent.

Your Loanboox-Team